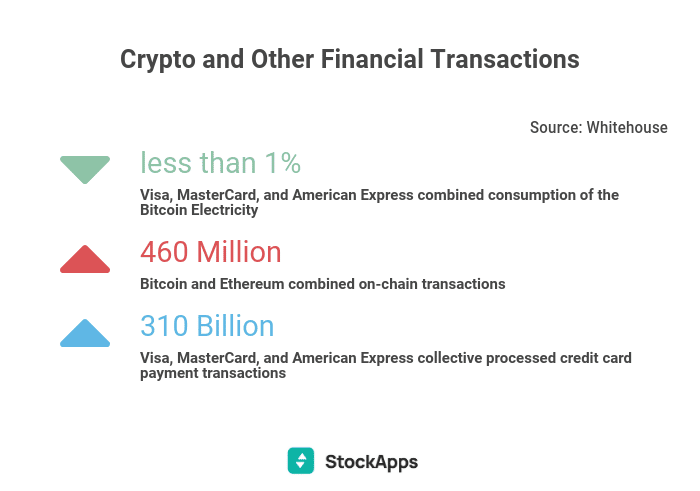

Bitcoin can be an investment, but it’s also a payment network with real-world utility That means that, in addition to being bought and sold on exchanges like traditional investments, bitcoins can also be used to purchase goods and services—or even other cryptocurrencies. StockApps reveals that Visa, MasterCard, and American Express combined consume less than 1% of Bitcoin electricity.

Although precise comparisons are challenging, Visa, MasterCard, and American Express all reported using roughly 0.5 billion kWh of electricity in 2020.

Speaking on the data, StockApps’ specialist, Edith Reads, said. “Most people prefer cashless transactions. Bitcoin and credit cards are both giving that service. But, Credit cards are environmentally conscious since they only use a small amount of electricity.”

Businesses that accept credit cards require formal banking ties to settle transactions. The transactions approve payments, not make them. Due to this, there is a clear distinction between a transaction involving digital assets and one involving a credit card.

Traditional Banking System

Traditional banking consumes higher electricity. The use of data centers and the operation of bank branches all rely on power. Besides, the running of digital payments networks comprising card systems and ATMs needs the most electricity in the chain for a conventional banking system.

Card networks include the systems managed on a global scale by financial firms such as Mastercard, Visa, and American Express. Bitcoin has no real-world value. A subset of the population maintains that mining cryptocurrency wastes time and resources.

The energy needed to mine cryptos like Bitcoin and Ethereum is high. This activity’s impact on the environment has brought these digital currencies and others into the public eye.

Bitcoin as a Medium of Exchange

Bitcoin is failing as a medium of exchange. There is a lot of fuss about it, and there are workarounds for sellers like Amazon that will not accept it. After a decade of promises, bitcoin is still not fungible. Moreover, it is heavily devalued in the few transactions where it applies.

Over time, merchants’ crypto adoption in the economy may improve, maybe with protections. Stablecoins ensure stable crypto prices by pegging them to real money, i.e., U.S. dollars. Like the old dollar-gold ratio.

Bitcoin and Ethereum rely on blockchains with minimal transaction capacity. Bitcoin’s global transaction limit is 7 per second. Yet, Mastercard, Visa, and AmEx process roughly 1250 transactions per second.